ev charger tax credit form

The credit for the business use of an electric vehicle is reported on Form 3800 General Business Credit. Many jurisdictions and utilities offer.

In fact have penalties for EV buyers in the form of higher registration costs.

. Why you plug it in of course. It produces a rapid-fire charge and has LED indicator lights that notify you of any charging errors. Eligible for the Federal Rebate Program.

Alternative Fuel Vehicle Refueling Property Credit. The Ford Ranger EV Electric Vehicle is a battery powered compact pickup truck that was produced by the Ford motor companyIt was produced starting in the 1998 model year through 2002 and is no longer in production. Grizzl-E Avalanche NEMA 06-50 Plug with 24 Feet Premium Cable is a simple powerful heavy-duty and portable Electric Vehicle Charging Station which is suitable any weather.

Below is our latest long-term forecast for new electric vehicle BEV and PHEV sales in the US through 2030. The Federal EV Tax Credit is not a direct discount at the point of purchase or a tax deduction its a dollar for dollar reduction in the amount of tax you owe when you file your taxes the year following your purchase. There are many incentives and tax credits for installing electric-vehicle charging stations available all over the US.

ChargePoint Home Flex WiFi Enabled EV Charger. EV sales should grow to reach approximately 295 of all new car sales in 2030 from an expect roughly 34 in 2021. Compatible with all EVs and PHEVs sold in North America.

January 2022 Department of the Treasury Internal Revenue Service. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Standard J1772 cable fit to most EVs Level 12 charging capable LED indicator lights to manage charging errors 21ft cable fit to most driveways.

But in reality you use a charger that converts the 120-volt alternating current AC available from a typical wall outlet into a current that your phone can use to charge its battery. Ranging from 1000 per Level 2 charger up to 42000 per multiport DC fast charger. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED.

For more information about claiming the credit see IRS Form 8911 which is available on the IRS Forms and Publications website. The Lectron EV Charger can make EV use way easier by supplementing your factory-issued charger. For the federal tax credit youll need to submit IRS Form 8911 when you file your business taxes.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Then claim the credit on your federal tax return. It is built upon a light truck chassis used in the Ford RangerA few vehicles with lead-acid batteries were sold but most units were leased for fleet use.

This form walks you through. That conversion of power into a form that an EVs battery pack can accept is exactly what an electric vehicle charging station does. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure.

If you claimed an alternative fuels tax credit in any tax year that began before January 1 2011 use Form CT-40 Alternative Fuels and Electric Vehicle Recharging Property Credit or Form IT-253 Claim for Alternative Fuels Credit to claim a credit carryover or to calculate any recapture of the alternative fuels credit that was allowed. Grab IRS form 8911 or use our handy guide to get your credit. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Lectron 240V 40 Amp Level 2 EV Charger. Attach to your tax return. Most EVs are eligible for the federal governments tax credit program which can reduce what you owe the IRS by up to 7500 for single.

Just buy and install by December 31 2021 then claim the credit on your federal tax return. JuiceBox Smart EV Charger. Alternative Fuel Infrastructure Tax Credit.

The Federal tax credit of up to 30 of the chargers cost up to a maximum of 1000 expired at the end of 2021 but is likely to be extended for 2022 a bill doing so has already passed the US. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Reference Public Law 116-260 Public Law 116-94 Public Law 115-123 Public Law 114-113 26 US.

Grizzl-E Home Level 2 EV Charging Station. Code 30C and 38 and IRS Notice 2007-43.

How To Claim An Electric Vehicle Tax Credit Enel X

Tax Credit For Electric Vehicle Chargers Enel X

Uk Unveils Extensive New Plan To Go All Electric By 2040 Last Year The Electric Car Charging Electric Vehicle Charging Electric Vehicle Charging Station

Electric Vehicle Charger Installation

Commercial Ev Charging Incentives In 2022 Revision Energy

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Featured Design Strategy Work Supermarket Design Design Strategy Parking Design

Residential Charging Station Tax Credit Evocharge

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

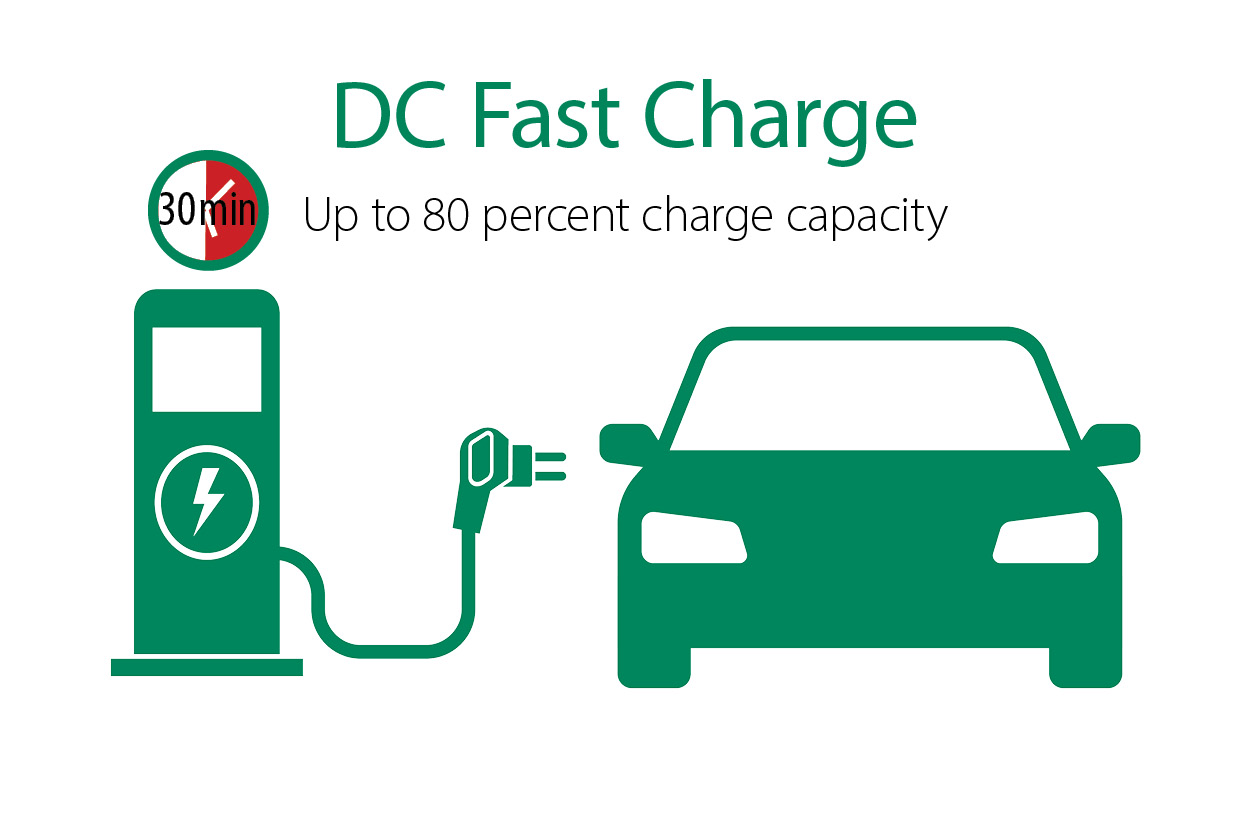

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique

Ev Charging Stations 101 Wright Hennepin

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Rebates And Tax Credits For Electric Vehicle Charging Stations

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car