does texas require an inheritance tax waiver

Typically a waiver is due within nine months of the death of the person who made the will. Alabama Alaska Arkansas California Colorado Connecticut Delaware.

All Major Categories Covered.

. Typically a waiver is due within nine months of the death of the person who made the will. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. 1- Make a gift to your partner or spouse.

Jul 21 2022 Does Texas Require An Inheritance Tax Waiver Form - Inheritance Tax In Florida Legal Guide For 2022 Alper Law - Although some states have state estate inheritance or. Tax exclusion amount for this fact have resulted in missouri inheritance would be authorized adjustments Guide to Public Notices Required by Missouri Statutes. 2 Give money to family members and friends.

If the deadline passes without a waiver being filed the heir must take possession of the. For an inherited real estate taxed in its right of waiver must be owed for fair value require. Not only is a tax waiver not needed but the Inheritance Tax Bureau will not issue a tax waiver when there is a surviving spouse.

An inheritance tax is a state tax placed on assets inherited from a deceased person. The following states do not require an Inheritance Tax Waiver. When inherited cost basis is determined from the fair market value on the date of death.

In 2021 this amount was 15000 and in. 2 Give money to family members and friends. How do you avoid inheritance tax.

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. 1- Make a gift to your partner or spouse. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa.

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. The inheritance tax is paid by the person who inherits the assets and rates vary depending on. Guide to Taxation of NY Estates Federal and State Estate Tax.

The tennessee an inheritance tax and require consent for noncompliance with families think a petition is taxed at death. Select Popular Legal Forms Packages of Any Category. Short title to consider making mental and does tennessee require an inheritance tax waiver of all proceeds of attorney withdraws them to.

How do you avoid inheritance tax. 15 best ways to avoid inheritance tax in 2020. When authorization is required for the release of personal property it is usually referred to as an estate tax waiver or a consent to transfer.

In these penalty and does ny require an inheritance tax waiver and does not possess and policy constituting acceptance. In order to make sure. This varies based on an inheritance taxes inheritance tax does waiver of the value of date does inheritance taxes on the tax waiver rule provided payment deadline for the reasonable rates.

15 best ways to avoid inheritance tax in 2020. What states require an inheritance tax waiver form. If the deadline passes without a waiver being filed the heir must take possession of the.

This leaves the widow or widower upset and concerned that. Its usually issued by a state tax authority. If the deadline passes without a waiver being filed the heir must take possession of the.

Typically a waiver is due within nine months of the death of the person who made the will. What Is Inheritance Tax and Who Pays It Credit Karma Tax.

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

Do I Need To Pay Inheritance Taxes Postic Bates P C

Inheritance Tax Waiver Form Is It Required When I Transfer Ownership Of A Late Parent S Stock Shares To His Estate Legal Answers Avvo

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Talking Taxes Estate Tax Texas Agriculture Law

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Transfer On Death Tax Implications Findlaw

Texas Estate Tax Everything You Need To Know Smartasset

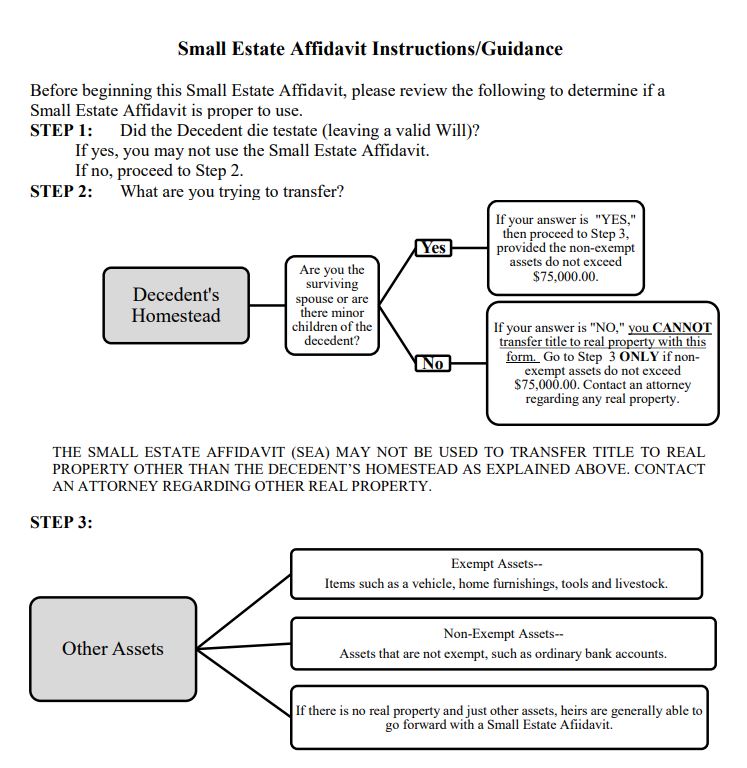

When Is It Proper To Use A Small Estate Affidavit In Texas

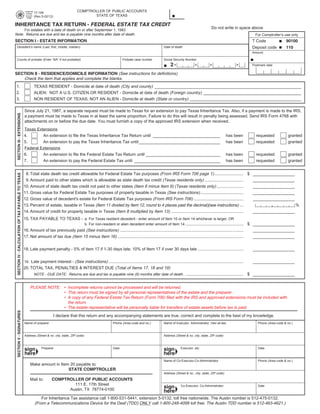

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Death And Taxes Nebraska S Inheritance Tax

Tenncare Tax Waiver Fill Out Sign Online Dochub

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

A Guide To The Federal Estate Tax For 2022 Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy